The 2026 Fiscal-Monetary Accord: Why Warsh’s Plan Ends Fed Independence

The consensus view holds that the Federal Reserve’s primary mandate remains price stability. This is a category error. When sovereign debt exceeds 120% of GDP and interest expense consumes nearly a third of federal tax receipts, the central bank’s existential mandate shifts from fighting inflation to preventing sovereign insolvency.

Kevin Warsh’s recent framework for a Fiscal-Monetary Accord Revival is not merely a policy suggestion; it is the inevitable architectural blueprint for the next phase of American finance. It represents the structural end of the post-1951 era of central bank independence. For quantitative allocators, this signals that standard risk models relying on mean-reverting real rates are obsolete. We are moving from a regime of risk-free rates to a regime of return-free risk, managed explicitly through administrative yield caps.

Deconstructing Warsh’s Proposal: A Soft Yield Curve Control

The original Treasury-Federal Reserve Accord of 1951 was designed to separate debt management from monetary policy, ending the WWII-era practice of the Fed pegging interest rates to help the Treasury borrow cheaply. Warsh’s proposal effectively reverses this separation, albeit with more sophisticated nomenclature.

Reversing the 1951 Accord

The core of the proposal involves a formal "joint statement" or memorandum of understanding where the Fed acknowledges that the stability of the sovereign debt market is a prerequisite for monetary transmission. In practice, this legitimizes the Fed’s balance sheet as a permanent dumping ground for Treasury duration that the private market refuses to absorb at negative real yields.

Unlike Quantitative Easing (QE), which was framed as a temporary stimulus tool, this Accord institutionalizes joint liability management. The Treasury issues debt, and the Fed manages the pricing of that debt not to stimulate growth, but to ensure the Treasury's auction mechanics do not fail.

The Mechanics of Joint Liability Management

The implementation mechanism relies on shortening the duration of the consolidated government balance sheet.

- Treasury Issuance: The Treasury continues to issue long-dated bonds (10s and 30s) to lock in funding.

- Fed Intermediation: The Fed buys these long-dated assets, funding the purchase by issuing bank reserves (overnight liabilities).

- Net Result: The private sector holds short-term, floating-rate risk (reserves), while the public sector absorbs the duration risk.

This transforms the Fed into the world's largest hedge fund with a massive duration mismatch—a position that is technically insolvent on a mark-to-market basis but irrelevant for a central bank that cannot default in its own currency.

Case Study: The BTFP as the Proto-Accord

To understand how the 2026 Accord will function, we need only look at the Bank Term Funding Program (BTFP) launched in March 2023. This was the beta test for the new regime.

When regional banks faced insolvency due to holding underwater Treasuries, the Fed did not force them to sell at market prices. Instead, the Fed accepted these bonds as collateral at par value, ignoring the market discount.

The Quantitative Implication:- Market Reality: A 10-year Treasury yielding 1.5% was trading at ~80 cents on the dollar.

- Regulatory Reality: The Fed valued it at 100 cents.

The BTFP effectively created a "shadow bid" for Treasuries. It told the market that duration risk would be nationalized if it threatened systemic stability. The Warsh plan scales this from a temporary emergency facility for banks to a permanent structural feature for the US Treasury itself. It is a soft default mechanism: the debt is honored, but the currency in which it is paid is debased to ensure the yield remains serviceable.

The Mechanics of Fiscal Dominance in a $30 Trillion Market

The arithmetic of the US fiscal situation dictates that the Fed has lost the ability to set interest rates based solely on the Taylor Rule or the Phillips Curve.

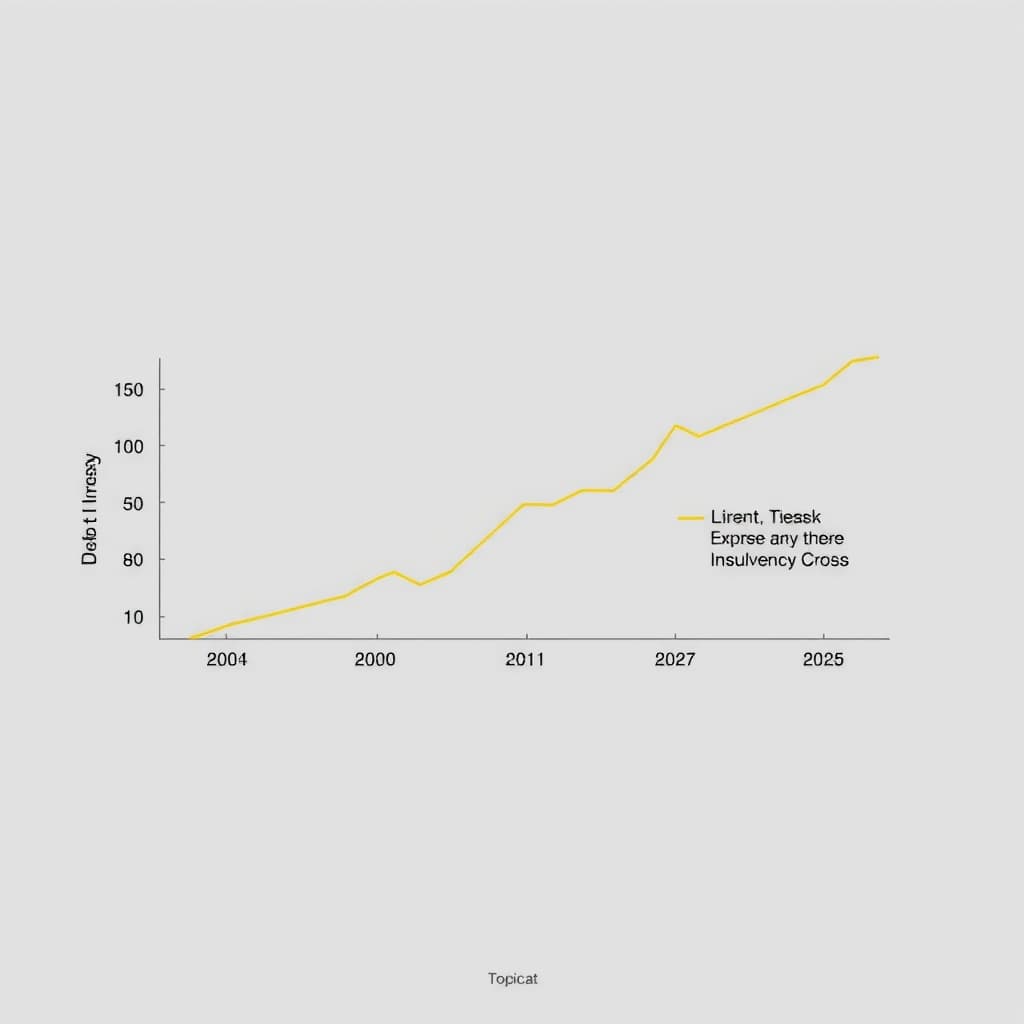

The Insolvency Cross

We are currently witnessing the "Insolvency Cross." This occurs when the weighted average coupon on government debt rises faster than nominal GDP growth.

- Scenario: If the Fed maintains rates at 5% to fight inflation, interest expense on $35 trillion of debt approaches $1.75 trillion annually.

- Constraint: This exceeds the entire discretionary budget of the US government.

Under the proposed Accord, the Fed explicitly caps yields (likely via a distinct facility akin to the Japanese Yield Curve Control) to keep interest expense below a specific percentage of GDP (e.g., 3%). This is Fiscal Dominance: the fiscal authority’s solvency constraints determine the monetary authority’s actions.

Calculated Inflation: Sacrificing the 2% Target

The unspoken objective of the Accord is to engineer a period where inflation (4-5%) consistently exceeds interest rates (capped at 3-3.5%). This negative real yield environment transfers wealth from bondholders to the sovereign, deleveraging the government in real terms. The 2% inflation target becomes a legacy rhetorical device, while the actual policy target becomes Nominal GDP Targeting, allowing inflation to run hot to liquefy the debt overhang.

Repricing Risk: Bond Vigilantes vs. The Treasury Put

In a free market, "bond vigilantes" sell bonds when fiscal discipline erodes, driving yields up to force austerity. The Accord neutralizes this feedback loop.

The Death of the Term Premium

If the Fed commits to capping long-end yields, the term premium—the extra compensation investors demand for holding long-term risk—collapses.

Regulatory Repression

The Accord will likely be paired with regulatory changes forcing liquidity providers to hold more sovereign paper. We can expect updates to the Liquidity Coverage Ratio (LCR) or Supplementary Leverage Ratio (SLR) that favor Treasuries over other high-quality liquid assets (HQLA). This creates forced buying demand from the banking sector, reducing the amount of QE the Fed must perform directly.

The 2026 Roadmap: Institutionalizing Financial Repression

For the practitioner, the implementation of this Accord changes the correlation matrix of major asset classes.

The Shift from Price Discovery to Managed Curves

We are moving away from price discovery in the world's most important collateral. The Treasury market will function less like a market and more like a utility.

- Actionable Insight: Volatility strategies that rely on Treasury volatility (like the MOVE index) may see structural suppression, while currency volatility (G7 FX) will likely increase as the release valve for mispriced capital.

Implications for the 60/40 Portfolio

The 40% allocation to bonds has historically served as a hedge against deflation and equity drawdowns. Under the Accord, bonds become "certificates of confiscation" (negative real yields).

- Allocators must pivot: The "defensive" portion of the portfolio cannot be nominal government bonds. It must shift toward assets that have no counterparty liability but historically low beta to equities, or short-duration credit where yields can float.

Falsifiable Thesis & Indicators

The Thesis: The Fed will formally abandon pure inflation targeting in favor of a "range" or "average" that permits higher inflation to cap Treasury yields, formalized by a Warsh-style Accord by Q4 2026.

Watch these 3 indicators to confirm or refute:- SLR Exemption Permanence: If regulators permanently exclude Treasuries from the Supplementary Leverage Ratio calculation, the Accord is effectively active (forcing banks to buy debt).

- The "Standing Repo" Volume: A sharp, sustained rise in the usage of the Fed’s Standing Repo Facility indicates the private market is rejecting Treasury collateral, forcing the Fed to monetize it.

- Explicit Yield Cap Mention: If a Fed official explicitly mentions "managing the term structure to support financial stability" (refutation: If the Fed hikes rates past 6% despite a recession).

FAQ

What is the difference between the proposed Accord and Quantitative Easing? While QE is a monetary tool theoretically used to stimulate the economy during deflationary scares, a Fiscal-Monetary Accord is a structural governance change. QE is discretionary; the Accord is mandatory. It explicitly subordinates monetary policy to fiscal solvency, ensuring the Fed manages rates to keep the Treasury funded, regardless of the inflation outlook.

How does fiscal dominance affect the average investor? It typically results in "financial repression," where interest rates are kept below the rate of inflation. This erodes the purchasing power of cash and nominal bonds. Investors holding cash or long-term Treasuries essentially pay a hidden tax to the government. To preserve wealth, capital must flow into hard assets, equities with pricing power, or alternative stores of value that cannot be diluted.

Sources

Loading comments...

Related

View all →

Federalized Oracle Jurisdiction: How Washington is Preempting State Bans on Prediction Markets