Federalized Oracle Jurisdiction: How Washington is Preempting State Bans on Prediction Markets

The prevailing narrative suggests that the future of prediction markets depends on a patchwork of state-level approvals, similar to the slow roll-out of sports betting post-PASPA. This view is fundamentally obsolete. The real battleground has already shifted to Washington, where a quiet but decisive administrative maneuver is establishing Federalized Oracle Jurisdiction. By elevating platforms like Kalshi and Polymarket from "gaming operators" to federally regulated exchanges, the administration is effectively nullifying state gambling laws through the Supremacy Clause. We are not witnessing the legalization of gambling; we are witnessing the weaponization of the Commodity Exchange Act (CEA) to create a national truth ledger.

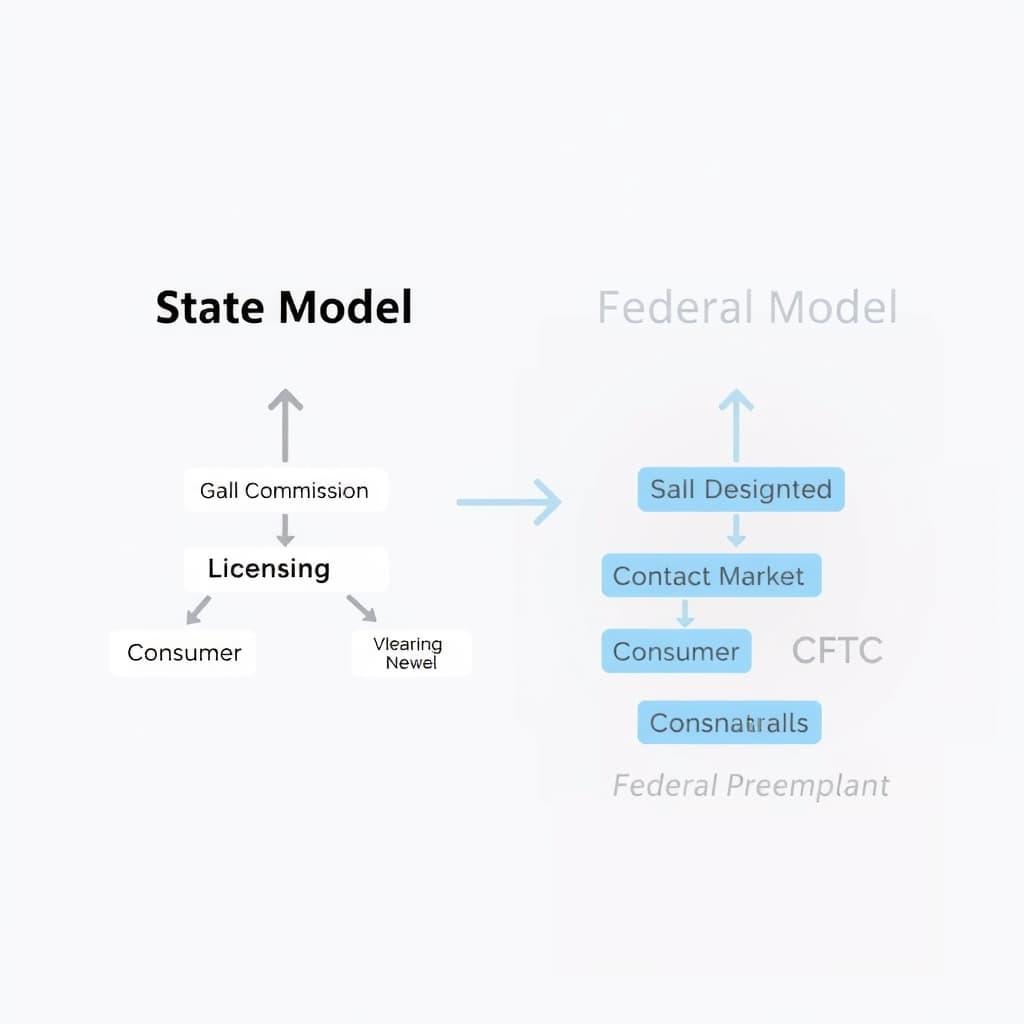

Visualizing the Power Shift

The following hierarchy illustrates how federal preemption physically disconnects state regulators from the transaction loop.

The Preemption Playbook: Weaponizing the Commodity Exchange Act

The legal mechanism dismantling state bans is not a new law, but a rigorous application of the Commodity Exchange Act (CEA). For decades, the definition of a "commodity" has expanded from wheat and corn to interest rates and energy credits. The current administration’s push to classify "event contracts"—wagers on election outcomes, policy decisions, or corporate milestones—as financial derivatives is the final nail in the coffin for local prohibition.

Defining 'Event Contracts' to Bypass State Statutes

State gambling statutes almost universally rely on definitions of "games of chance" or "wagering." However, once the Commodity Futures Trading Commission (CFTC) accepts a contract certification, that instrument legally becomes a derivative. Under the doctrine of preemption, a federally regulated financial instrument cannot be banned by a state as "gambling," any more than New York could ban the trading of Apple stock by calling it a "wager on corporate performance."

The precedent set by the Kalshi v. CFTC litigation in the mid-2020s established that the CFTC could not arbitrarily block election contracts if they met the economic requirements of the CEA. By leaning into this ruling, the current administration is actively encouraging exchanges to self-certify contracts. This forces state attorneys general into a losing battle: to ban Kalshi, they must effectively argue that they have jurisdiction over federal commodities markets—a constitutional non-starter.

The Constitutional Leverage of Interstate Commerce

Digital prediction markets are inherently borderless. A trader in Wyoming hedging against a corporate tax hike is trading against a counterparty in Florida. This is the definition of Interstate Commerce. By asserting federal oversight, Washington is stripping states of their police powers regarding these markets. The logic is brutal but effective: if the liquidity is national, the regulator must be federal. This prevents the fragmentation of liquidity that plagues the sports betting industry, where a bettor in New Jersey cannot trade against a bettor in Nevada.

From Vice to Oracle: Reclassifying Speculative Data as a Utility

The government’s support for these markets is not rooted in libertarian ideology but in pragmatic utility. Federal regulators have recognized that prediction markets generate a proprietary economic output: high-fidelity probability data.

Price Discovery as a Protected Economic Output

In a volatile geopolitical environment, the "price" of a specific outcome (e.g., a 30% chance of a Taiwan Strait blockade) is a critical input for supply chain managers and insurers. When a state bans a prediction market, they are not just stopping a bet; they are censoring a price signal. The administration’s stance is that obstructing this price discovery harms the national economic interest. This reclassification transforms the market operator from a "bookie" into a "data vendor," a category that enjoys significantly higher regulatory protection.

Separating 'Hedging Utility' from 'Games of Chance'

To solidify this jurisdiction, regulators are emphasizing the "hedging" component of these contracts. If a solar energy firm uses a prediction market to hedge against the repeal of tax credits, that transaction is functionally identical to an airline hedging fuel costs. By validating the hedging utility, the CFTC isolates these markets from the "entertainment" bucket used by sportsbooks, placing them firmly within the financial infrastructure.

The Polymarket Paradox: Offshore Crypto Meets Onshore Policy

The most complex friction point remains Polymarket. While Kalshi operates within the domestic banking system, Polymarket’s foundation on decentralized ledgers presents a unique challenge to the Federalized Oracle thesis.

Forcing Offshore Liquidity Onshore

The administration’s strategy involves a "comply or die" ultimatum, sweetened by the promise of the world’s deepest capital pool. By offering a clear path to registration as a Designated Contract Market (DCM) or Swap Execution Facility (SEF), Washington is tempting offshore liquidity to migrate. The trade-off is clear: Polymarket can remain a decentralized outlier with limited access to US institutional capital, or it can integrate its order book with CFTC reporting standards to capture the trillions in US corporate hedging flows.

Technical Friction: Decentralized Resolution vs. CFTC Reporting

The core conflict is technical. The CFTC requires a centralized clearing model to guarantee trades and prevent money laundering. Decentralized oracles (like UMA) used by crypto-native markets to resolve outcomes do not currently fit this mold. We are likely to see a hybrid architecture emerge by late 2026: "Permissioned DeFi," where the execution layer remains on-chain for transparency, but the settlement and identity layers are gated by federally regulated custodians.

The 2026-2030 Roadmap: Standardizing the National Truth Ledger

As the legal dust settles, the focus shifts to integration. The prediction market is moving from a niche internet curiosity to a line item on brokerage statements.

Integration into Traditional Brokerage Terminals

The endgame for Federalized Oracle Jurisdiction is the commoditization of access. By 2028, we expect prediction market feeds to be standard integrations in retail brokerage accounts (e.g., Robinhood, Schwab) and institutional terminals (Bloomberg). When a trader analyzes a stock, they will see the "implied probability" of relevant regulatory events derived directly from prediction markets, sitting right next to P/E ratios.

The Tax Classification Battle

The final frontier is taxation. Currently, the tax treatment of prediction market profits is ambiguous. The shift to federal jurisdiction sets the stage for a major battle over Section 1256 of the tax code. If these are truly futures contracts, traders are entitled to the 60/40 split (60% long-term capital gains, 40% short-term), regardless of holding period. This is vastly superior to the ordinary income tax rates applied to gambling winnings. The Treasury will likely resist this revenue drop, but the legal classification of "commodity" makes the 1256 treatment difficult to deny.

Strategic Decision Matrix: The Operator's Dilemma

For platforms operating in this space, the choice of jurisdiction dictates the business model.

What Would Change My Mind?

The thesis of inevitable federalization relies on the courts upholding the definition of "event contracts" as commodities. If the Supreme Court were to rule that prediction markets regarding political events lack an "economic purpose" and are therefore exclusively under the purview of state police powers (similar to the logic used in some anti-commandeering cases), the federal shield would collapse. Additionally, if Congress passes specific legislation explicitly excluding "political contests" from the definition of a commodity—a move occasionally threatened by bipartisan coalitions concerned about "election integrity"—the jurisdiction would revert instantly to the states.

Conclusion

The era of asking permission from fifty different gaming commissions is ending. By treating prediction markets as instruments of financial hedging rather than vehicles of vice, the administration has constructed a regulatory moat that local authorities cannot cross. The question is no longer if these markets will exist in the US, but how quickly the traditional financial plumbing can be retrofitted to carry their data.

FAQ

How does federal preemption stop states from banning Kalshi? Under the Supremacy Clause of the Constitution, valid federal regulations override conflicting state laws. Once the CFTC designates these contracts as financial derivatives under the Commodity Exchange Act, they enter a federally occupied field. State gambling definitions become legally subordinate, meaning a state cannot prosecute a federally sanctioned exchange for "gambling."

Does this make Polymarket legal for US traders immediately? Not automatically. While the jurisdiction is shifting to the federal level, Polymarket must still register as a Designated Contract Market (DCM) or Swap Execution Facility (SEF) to legally solicit US customers. The federal shift removes the state ban hurdle, but it imposes the federal registration hurdle, which requires strict KYC/AML compliance.

Sources

Loading comments...

Related

View all →