Martyr-Equity Urbanism: How Pyongyang Securitizes War Dead for Real Estate

Most geopolitical analysts fundamentally misprice the North Korean troop deployment to Ukraine. They view it as a desperate diplomatic bid for Russian protection or a simple mercenary exchange. They are wrong. What we are witnessing is the birth of Martyr-Equity Urbanism—a sophisticated macroeconomic strategy where the Kim regime securitizes future military casualties to underwrite domestic real estate development.

Pyongyang is not merely selling soldiers; it is hedging regime stability. By converting the volatility of foreign combat revenue into the fixed assets of the Pyongyang skyline, the state effectively sterilizes the inflationary impact of Russian payments while creating a physical collateralization of loyalty. This is the ultimate financialization of the military-industrial complex: death is no longer a write-off; it is a liquidity event for state infrastructure.

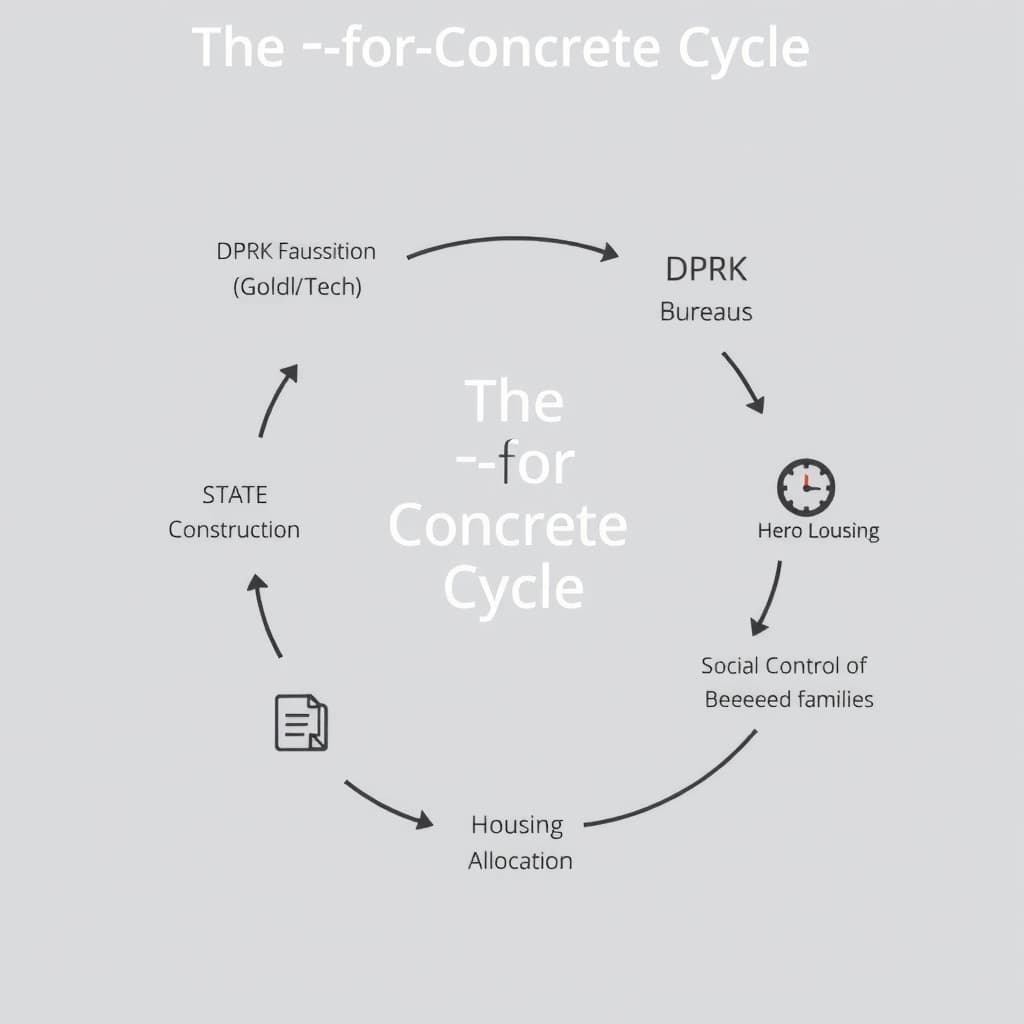

Tracing the Ruble-to-Rebar Conversion Cycle

To understand the genius—and the horror—of this model, one must follow the liquidity, not the rhetoric. When Russia settles its debts for North Korean manpower, it does not do so via SWIFT transfers that trickle down to soldier accounts. The settlement mechanism is a closed loop designed to bypass sanctions and domestic inflation.

Liquidity Mechanisms and Sanction Evasion

Moscow settles these obligations through a combination of direct commodity transfers (oil, grain), technical assistance, and bullion/hard currency moved outside the traditional banking layer. If this liquidity hit the North Korean jangmadang (black markets) directly as cash payouts to families, it would trigger hyperinflation and devalue the North Korean Won.

Instead, the regime captures 100% of the external revenue. The Central Bank of the DPRK absorbs the Russian payments (the "Alpha" generation). It then issues domestic credit and material orders to state-owned construction enterprises (e.g., the 7th and 8th General Bureaus). The "payment" to the soldier’s family is not cash, but the right to reside in a new, high-rise apartment.

Asset Allocation as Monetary Control

This shift from cash compensation to asset allocation is critical. In a command economy, concrete is cheaper than credibility.

- The State's Cost: The marginal cost of building these units is negligible—labor is conscripted (often the very units not deployed to Ukraine), and materials are domestically sourced (cement, steel).

- The Perceived Value: To a North Korean family, a modern apartment in a district like Hwasong or the newly planned "Patriot" zones represents generational wealth and survival.

By paying in concrete, the regime retains the Russian hard currency for strategic weapons programs while satisfying domestic debt obligations with non-fungible, state-controlled assets.

The Valuation of Valor: Human Capital as a Liquid Asset

We must look at the actuarial tables the way the Workers' Party of Korea does. A deployed soldier represents a "Replacement Cost" versus a "Yield." In the Ukrainian theater, the soldier generates a yield (Russian payments) significantly higher than their domestic economic output. However, the liability arises when that soldier is killed.

Calculus of Compensation

The traditional model of veteran benefits relies on long-term pension obligations funded by tax revenue. Martyr-Equity Urbanism flips this. The compensation is a one-time capital expenditure (the apartment) that requires no ongoing cash flow from the state, other than minimal utilities.

The following table illustrates why Real Estate is the preferred settlement vehicle over Fiat Currency for the regime:

The "Hero" Arbitrage

Pyongyang is effectively arbitraging the difference between the global market value of a mercenary (paid by Russia) and the domestic production cost of an apartment (paid to the family). As long as the Russian payout per head exceeds the raw material cost of a housing unit, the war is a net-positive revenue generator for the construction sector.

Architectural Brutalism Meets Social Engineering

The design specifications of these new "Patriot Districts" reveal their secondary function: surveillance. These are not organic neighborhoods; they are containment zones.

Surveillance Integration vs. Structural Longevity

Recent satellite imagery and defector testimonies regarding newer developments suggest a priority on visibility. Wide boulevards and clustered high-rises minimize blind spots. The "Patriot" designation allows the Ministry of State Security to concentrate bereaved families in specific sectors.

The Psychology of Segregation

Clustering the families of the fallen serves a grim prophylactic purpose. If a single mother in a rural province complains that her son died for a foreign war, she might incite local unrest. If she is moved to a prestigious Pyongyang high-rise surrounded by other "beneficiaries," two things happen:

- Peer Monitoring: The community polices itself. Dissent risks the collective status of the block.

- Dependency: Eviction means a return to poverty. The apartment is a golden handcuff.

This creates a "Potemkin Village" effect where the most aggrieved demographic—those who have lost children to the state's ambitions—are visually presented as the most pampered, silencing their grief with the spectacle of modernization.

Exporting the Model: The Pariah Economy Outlook (2026-2030)

This model will not remain unique to North Korea. As global sanctions bifurcate the world economy, other pariah states and non-state actors will likely adopt Martyr-Equity schemes.

The Proliferation of Asset-Backed Mercenarism

We anticipate that by 2027, entities like the Iranian IRGC or sanctioned PMCs (Private Military Companies) operating in Africa may adopt similar "Land-for-Blood" compensation models. When access to global banking is cut, land and housing become the only viable currency for large-scale personnel payments.

Solvency Risks

The long-term risk for Pyongyang is the "vacancy rate" of war. This economic model relies on perpetual conflict. If the war in Ukraine ends or Russian payments cease, the capital injection for new construction halts, but the demand for housing (and the backlog of promises to families) remains. The regime is effectively betting that global instability will last long enough to complete its 50,000-unit housing goals.

Trade-offs: The Regime's Dilemma

What Would Change My Mind?

My thesis relies on the continued efficiency of the Russia-DPRK payment channel. If the Russian Federation were to default on these payments, or shift to a credit-based system that Pyongyang cannot immediately monetize, the construction boom would stall, leading to a crisis of expectations. Furthermore, if we see evidence of widespread refusal to occupy these new districts due to "ghost spirits" (a strong cultural superstition in Korea regarding violent death) or poor construction quality, the social control aspect of the model collapses.

Conclusion

Martyr-Equity Urbanism is a grim innovation in the economics of tyranny. It solves the dictator's dual problem of financing foreign adventures while placating domestic grief. By turning dead soldiers into skyline equity, Kim Jong Un has integrated the battlefield into the balance sheet. For the next five years, watch the cranes in Pyongyang—they are the leading indicators of the offensive in the Donbas.

FAQ

How does this economic model differ from traditional veteran benefits? Traditional benefits are social safety nets funded by tax revenue to support reintegration. Martyr-Equity Urbanism is a transactional exchange where foreign combat revenue directly funds the asset creation. It functions closer to a dividend payout from a mercenary operation than a state welfare program.

Can these housing projects sustain the North Korean economy? They provide a temporary construction boom and absorb labor, effectively masking unemployment. However, they are non-productive assets. They do not generate goods or services. Without a continuous influx of foreign capital (war payments), the maintenance and utility costs will eventually strain the state budget, potentially turning these districts into decaying slums within a decade.

Sources

- Center for Strategic and International Studies (CSIS) - North Korea's Munitions and Troops

- 38 North - Analysis of North Korean Construction & Housing

- NK News - Tracking DPRK Housing Developments

- Institute for the Study of War (ISW) - Russia-North Korea Cooperation

- Bank of Korea - North Korea Economic Estimates

Loading comments...

Related

View all →

Federalized Oracle Jurisdiction: How Washington is Preempting State Bans on Prediction Markets