Phantom-Ledger Fragility: The $43 Billion Glitch Exposing Exchange Insolvency Risks

Phantom-Ledger Fragility: The $43 Billion Glitch Exposing Exchange Insolvency Risks

The prevailing narrative treats the recent $43 billion accounting error at a major exchange as a localized failure of quality assurance—a "fat finger" incident to be mocked and moved past. This interpretation is dangerously naive. When an amount exceeding the GDP of many sovereign nations materializes out of thin air on a user interface, it is not merely a bug; it is a structural indictment of the "Web2.5" architecture that currently dominates crypto market infrastructure.

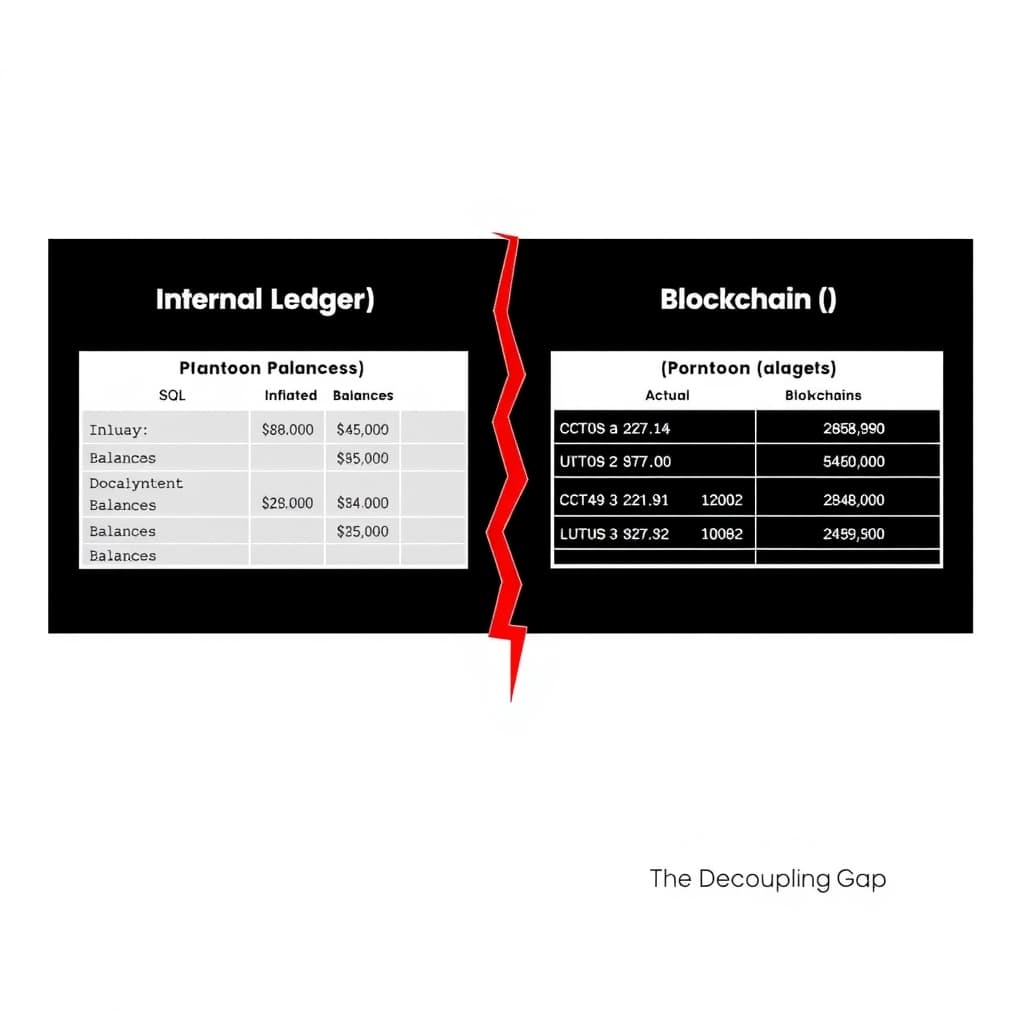

This phenomenon is Phantom-Ledger Fragility. It represents the critical vulnerability where a centralized exchange’s (CEX) internal SQL database—a mutable, private record—drifts from the immutable reality of the blockchain. For a few terrifying hours, the digital numbers on a screen decoupled completely from the underlying UTXO set, creating a solvency illusion that could have triggered a systemic liquidity crisis had it occurred during high volatility.

We are witnessing the inevitable friction of trying to mirror a decentralized, trustless settlement layer with a centralized, trust-based accounting engine. Until the industry abandons the "Trust Me" database model for cryptographic proofs, every centralized exchange remains a black box where user assets are only as safe as the latest database query.

The SQL-Blockchain Divide: Anatomy of a Database Fracture

The fundamental risk lies in the architectural dissonance between how exchanges execute trades and how they settle funds. To offer high-frequency trading (HFT) speeds, exchanges process orders off-chain in matching engines (often written in C++ or Rust) and update an internal ledger (SQL/NoSQL). They do not write to the blockchain for every trade; doing so would be prohibitively slow and expensive.

This creates a State Synchronization Latency. The exchange maintains a "Shadow Ledger" that is supposed to mirror the on-chain assets held in cold and hot wallets. Phantom-Ledger Fragility occurs when this synchronization breaks—due to integer overflows, race conditions, or bad logic—allowing the Shadow Ledger to credit users with assets that do not exist on-chain.

The Friction of Mutable vs. Immutable Accounting

In the Bithumb incident, the internal ledger credited users with massive sums of Bitcoin and other assets. Because SQL databases are mutable, a simple logic error in a crediting script can instantaneously generate infinite wealth within the closed system.

- Internal Reality: User A has 1,000 BTC ($96M).

- On-Chain Reality: The Exchange Hot Wallet has 50 BTC.

As long as User A trades within the exchange, the system functions. The phantom assets provide liquidity, fill order books, and drive volume. The catastrophe hits when User A attempts to withdraw. The exchange’s withdrawal engine queries the on-chain wallet, finds insufficient funds, and halts. If the discrepancy is small, the exchange might unknowingly run a fractional reserve. When the discrepancy is $43 billion, the illusion shatters immediately.

Desynchronization During Volatility

High-frequency trading engines compound this risk. During periods of extreme volatility, the rate of internal database updates (thousands per second) can outpace the reconciliation logic that checks against on-chain balances.

If an exchange's risk engine fails to lock a database row properly during a transfer (a race condition), a user might double-spend their balance internally before the system realizes the error. In legacy finance, T+2 settlement cycles allow days to correct these ledger errors. In crypto, where users expect near-instant finality, the window for correction is non-existent.

Liquidity Mirages and Systemic Contagion

The danger of phantom assets extends beyond the exchange that generates them. In an interconnected market dominated by algorithmic trading, a phantom ledger entry can trigger a contagion event across the wider ecosystem.

The 'Run-on-the-Bank' Vector

When news of a "glitch" spreads, rational actors withdraw immediately. This creates a self-fulfilling solvency crisis. Even if the exchange is fully solvent regarding real user deposits, the panic forces the exchange to drain cold wallets to hot wallets to meet withdrawal demand.

If the phantom assets were traded for real assets (e.g., Phantom BTC sold for Real USDT) before the glitch was caught, the exchange is now effectively insolvent. They owe Real USDT they do not have, creating a hole in the balance sheet that no audit can hide.

Algorithmic Hallucinations

Market makers and arbitrage bots rely on API data from exchanges to price assets globally. If a Phantom Ledger reports a massive influx of liquidity (even if fake), bots may adjust their strategies:

- False Depth: Bots perceive deep liquidity and place aggressive orders.

- Price Dislocation: If the phantom assets are dumped into the order book, the price on that exchange collapses.

- Arbitrage Loops: Bots buy the "cheap" assets on the glitching exchange and hedge on other venues, spreading the toxic exposure to healthy exchanges.

From Glitch to Malice: Bithumb vs. FTX

It is crucial to distinguish between incompetence (technical debt) and malice (fraud), though the outcome for the user—loss of funds—is often identical. Both Bithumb and FTX suffered from Phantom-Ledger Fragility, but the root causes differ.

Table 1: Taxonomy of Ledger FailuresWhy Snapshot Audits Fail

Traditional Proof of Reserves (PoR) often relies on a snapshot: a cryptographic picture of balances at a specific block height. While better than nothing, snapshots are insufficient for preventing Phantom-Ledger Fragility.

A snapshot proves that at 12:00 PM, the exchange had funds. It does not prove that at 12:05 PM, a database error didn't inflate user balances by 1000x. If the glitch occurs between snapshots, the exchange operates as a fractional reserve system until the next audit or the next bank run.

The Pivot to Real-Time Cryptographic Solvency

The industry cannot survive on "Trust Me" architectures patched with quarterly PDF reports. The only viable defense against Phantom-Ledger Fragility is the implementation of Cryptographic Proof of Solvency.

Implementing zk-SNARKs for Liability Proofs

Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge (zk-SNARKs) offer a path to validate the internal database without revealing user privacy.

In this model, the exchange generates a mathematical proof for every state transition.

- The Claim: "The sum of all user balances in our SQL database equals X, and we control on-chain addresses holding Y, where Y >= X."

- The Proof: A zk-proof verifies that the internal ledger's summation is correct and that no negative balances exist (to hide liabilities), without revealing individual user holdings.

- The Frequency: This must happen daily or even hourly, not quarterly.

Map of Incentives: Who Wins, Who Loses?

- The Exchange (Short-Term Loser, Long-Term Winner): Implementing real-time proofs is computationally expensive and removes the ability to run fractional reserves or commingle funds. However, it builds a defensive moat against bank runs.

- The Regulator (Winner): Automated solvency checks replace slow, manual oversight. Regulators can verify solvency via code rather than subpoenas.

- The HFT Firm (Winner): Reduced counterparty risk means they can deploy capital more efficiently without fear of exchange collapse.

- The Retail User (Winner): "Don't Trust, Verify" becomes a product feature, not just a slogan.

What Would Change My Mind?

I would reconsider the urgency of abandoning current SQL-based architectures if two unlikely developments occur. First, if global insurance markets mature to the point where they can underwrite the full deposit base of a Tier-1 exchange (>$50B) against technical glitches. Currently, capacity is nowhere near this level. Second, if a hybrid "Atomic Settlement" layer is developed that allows high-frequency trading directly on a settlement layer without the latency/cost trade-offs currently seen in DEXs, effectively making the internal SQL database obsolete. Until then, the disconnect between the database and the blockchain remains the primary systemic risk.

The End of the Black Box

The $43 billion error was a warning shot. It demonstrated that the digital numbers in a centralized exchange account are merely database entries, subject to the whims of code quality and internal controls.

We are moving toward a bifurcation in the market. On one side, "Black Box" exchanges that rely on reputation and legacy audits. On the other, "Glass Vault" exchanges that utilize cryptographic proofs to render Phantom-Ledger Fragility mathematically impossible. Capital will inevitably flow to the latter. In the era of algorithmic finance, solvency must be a function of code, not accounting.

FAQ

Q: What is the difference between an internal ledger and an on-chain ledger? A: An internal ledger is a private, centralized database (like SQL) used by exchanges to track user balances quickly and cheaply to facilitate high-speed trading. An on-chain ledger is the public blockchain (like Bitcoin or Ethereum) where actual funds settle. Discrepancies between the two create "phantom" assets.

Q: Can Proof of Reserves (PoR) prevent phantom asset glitches? A: Standard PoR provides a snapshot in time, which is useful but limited. It cannot prevent intra-day glitches or errors that happen between snapshots. Real-Time PoR or continuous Proof of Solvency is superior, as it uses cryptographic proofs to ensure that for every asset reflected in the internal database, a corresponding asset exists on-chain at that exact moment.

Sources

Loading comments...

Related

View all →

Beyond the Hype: How Institutional Discipline is Rewiring Bitcoin's Market Structure in 2026