Harvesting Chaos: The Institutional Shift to Structured Volatility Frameworks

Title: Harvesting Chaos: The Institutional Shift to Structured Volatility Frameworks

IntroductionThe era of "number go up" as the sole investment thesis is fading. In its place, a more sophisticated narrative is taking hold: "yield stays steady." For the first decade of decentralized finance, returns were largely a function of directional beta—if the market rallied, you won; if it crashed, you lost. Today, we are witnessing the industrialization of variance. The emergence of structured volatility frameworks has allowed capital to monetize market noise rather than predict market direction.

This shift is not merely a change in sentiment but a fundamental re-engineering of how yield is generated. By treating volatility not as a risk to be mitigated but as a raw resource to be harvested, protocols are converting the erratic energy of crypto assets into predictable, fixed-income-like streams. This analysis examines the mechanics behind this pivot, the institutional "Varntix Effect" driving standardization, and why the ability to monetize sideways markets is becoming the defining edge of the 2026 financial landscape.

Engineering Yield from Variance: How the Models Work

The transition from speculative token emissions to mathematically derived yield requires a move away from "printing" rewards toward "extracting" value from market inefficiencies. Structured volatility frameworks primarily utilize two mechanisms to achieve this: automated delta hedging and basis compression.

Moving Beyond Simple Staking

Unlike traditional staking, which relies on inflation or transaction fees, structured frameworks often employ automated option selling strategies. By systematically selling out-of-the-money call options (covered calls) or put options (cash-secured puts), these vaults capture the "volatility risk premium"—the tendency of implied volatility (what the market pays for options) to be higher than realized volatility (how much the price actually moves).

In a sophisticated framework, this is not a static strategy. Algorithms dynamically adjust strike prices and expiration dates based on real-time "Greeks" (Delta, Gamma, Theta) to maximize premium capture while minimizing the risk of assignment. The result is a yield derived from the market's fear and greed, rather than its appreciation.

The Role of Basis Trading

The second engine of these frameworks is the "cash and carry" or basis trade. In crypto markets, perpetual futures often trade at a premium to the spot price during bullish sentiment (positive funding rates). Structured frameworks automate a delta-neutral position: buying the spot asset and shorting the perpetual future.

This locks in the price difference (the basis) as profit, rendering the position immune to the underlying asset's price swings. As the contract matures or funding is paid out, the strategy accumulates yield. While retail traders chase leverage, structured frameworks act as the liquidity providers that facilitate that leverage, effectively taxing the speculators to pay the yield-seekers.

The Varntix Effect: Standardizing Risk for Big Capital

While delta-neutral strategies have existed for years, their packaging has historically been fragmented and complex. The entry of players like Varntix has catalyzed a shift toward "defined-outcome" products, a trend now referred to by analysts as the "Varntix Effect."

Pivoting from Open Speculation to Defined Outcomes

Institutions operate under strict mandates that often preclude open-ended drawdown risks. Varntix and similar Digital Asset Treasury (DAT) models have bridged this gap by wrapping complex derivative strategies into fixed-term, fixed-yield instruments. Instead of offering a variable APY that fluctuates with funding rates, these frameworks use over-collateralization and tranche-based risk management to offer a fixed return.

This "bond-ification" of crypto volatility allows pension funds and family offices to allocate capital to the sector. They are not buying Bitcoin; they are buying a structured note backed by the volatility of the Bitcoin market. This distinction is subtle but critical for regulatory and risk committee approval.

Quantifying Maximum Drawdowns

A key innovation in recent frameworks is the explicit capping of drawdowns. By utilizing "smart" collateral management—where assets are automatically rebalanced or hedged via put spreads when critical support levels are breached—these protocols can mathematically define the maximum possible loss (Max Loss) for a given tranche. This deterministic risk profile is a prerequisite for the entry of credit-focused institutional capital, which prioritizes capital preservation over asymmetric upside.

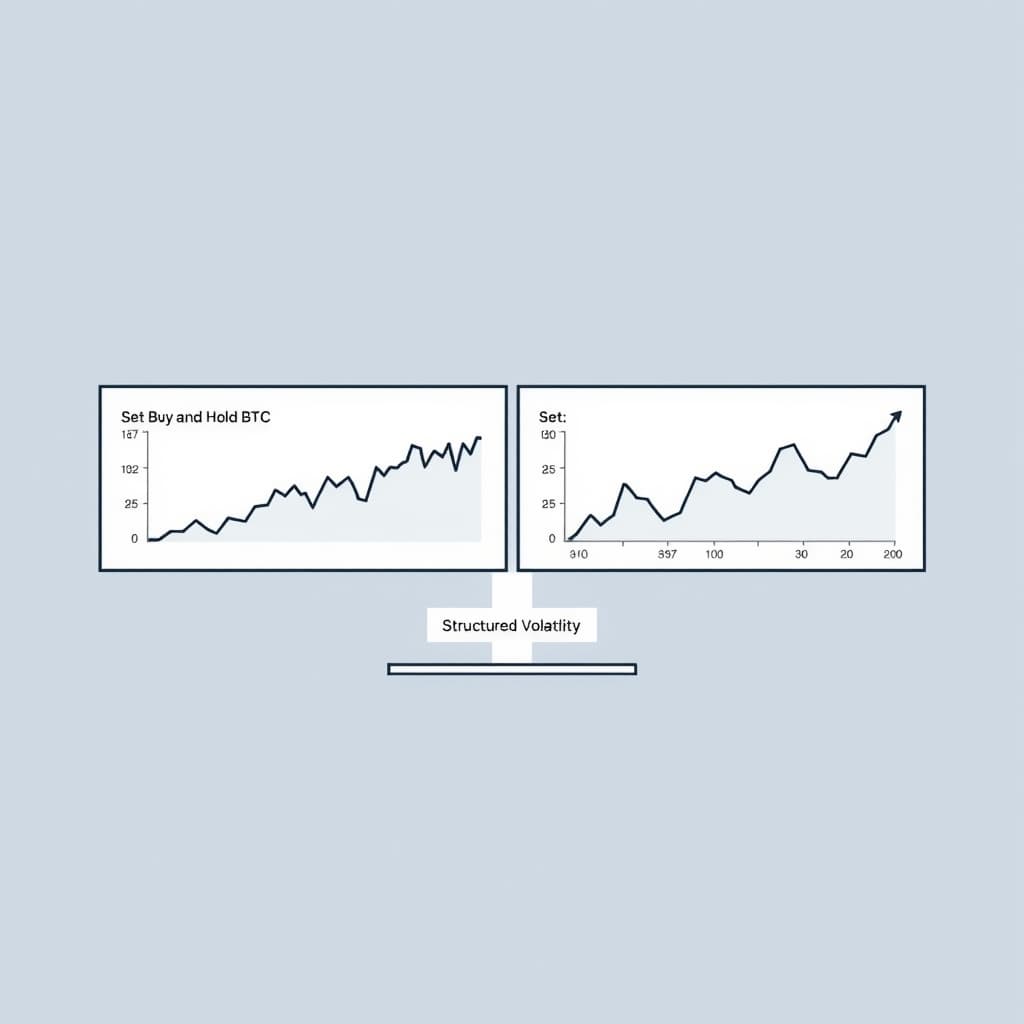

Comparison: Liquidity Mining vs. Structured VolatilityDecoupling Returns from Price Action

The ultimate value proposition of structured volatility is the decoupling of portfolio performance from asset price appreciation. In a mature market, "up only" is an anomaly; "choppy" is the norm.

Delta-Neutral as the Preferred Hedge

During the "crab markets" of late 2025, where major assets traded within a tight 5% range for months, traditional long-only funds saw stagnant returns. Conversely, volatility harvesting strategies outperformed significantly. By maintaining a delta-neutral stance (net exposure near zero), these portfolios profited from the existence of liquidity demand rather than the direction of the asset.

Case Study: The "Flash Crash" Stress Test

Consider the market correction of October 2025. While spot Bitcoin dropped 12% in a single day, well-constructed structured volatility vaults experienced a drawdown of less than 1.5%. The short positions in the derivatives leg of the strategy acted as a buffer, absorbing the shock of the spot price decline. Furthermore, the spike in implied volatility during the crash allowed these frameworks to sell subsequent options at significantly higher premiums, accelerating the recovery of the yield curve. This anti-fragile characteristic—where distress increases future yield potential—is the hallmark of a robust volatility framework.

The Road to 2030: Volatility as a Sovereign Asset Class

As we look toward the next decade, volatility will likely graduate from a strategy to a distinct asset class, tradable and transferable independent of the underlying tokens.

Tokenization of Volatility Tranches

We anticipate the emergence of secondary markets for "volatility tokens." Investors will be able to buy and sell specific tranches of risk—for example, buying a token that pays out only if realized volatility stays below 40%, or one that acts as insurance against "black swan" volatility spikes. This securitization of variance will allow for even more granular risk management.

Falsifiable Claim & Indicators

Claim: By Q4 2027, the Total Value Locked (TVL) in delta-neutral and structured volatility protocols will exceed the TVL of traditional directional lending protocols (like Aave or Compound) on Ethereum and L2s.

Indicators to Watch:- DEX Derivatives Volume: A sustained flip where options/perps volume exceeds spot volume on decentralized exchanges.

- Stablecoin Velocity: A rise in stablecoin inflows specifically into DOVs (Decentralized Options Vaults) and basis-trading vaults, diverging from inflows into spot-buying wallets.

- Yield Spread Compression: A narrowing of the spread between "risk-free" TradFi rates and crypto basis yields, indicating market saturation and efficiency.

Conclusion

Structured volatility frameworks mark the graduation of DeFi from a casino to a fixed-income alternative. The "Varntix Effect" has demonstrated that there is immense demand for products that convert the chaos of crypto markets into the order of predictable returns. As these protocols mature, the ability to monetize market noise will likely outperform the ability to predict market direction, making volatility the most valuable commodity in the digital asset ecosystem.

FAQ

How do structured volatility frameworks differ from standard liquidity mining? Unlike liquidity mining, which relies on inflationary token emissions and often carries the risk of impermanent loss, structured volatility frameworks derive yield from mathematically defined derivative strategies. They generate returns from the "real yield" of options premiums and basis spreads (funding rates), rather than speculative token distribution.

Is Varntix the only entity driving this trend? While Varntix is a notable catalyst in professionalizing these models—specifically in creating "Digital Asset Treasury" structures—the trend is industry-wide. It involves various decentralized options vaults (DOVs), basis trading platforms, and asset management firms seeking non-directional alpha in a maturing market.

Sources

- Varntix and the Future of Fixed Income in Digital Assets

- Mastering Options Volatility Term Structure | IBKR Quant

- Short-term risk-off volatility within a maturing Bitcoin regime - 21Shares

- Varntix: A New Titan in the Bitcoin and Crypto Treasury Race

- Crypto M&A in 2025: Key Themes Shaping Institutional Strategy

- Varntix Digital Asset Treasury Model Gains Attention

Loading comments...